Protecting Your Account: The Basics

Protectimg your account is easy...

Years ago, protecting your personal financial information was as easy as keeping your checkbook and bank statements in a secure location, but today it isn't that simple. Technology has forced most people into doing their shopping, banking, and even record-keeping digitally. Moving from the 'paper and pencil' to 'password' age can be overwhelming. Here is are some quick and easy ways you can keep your information safe on the web, lowering the chances that fraud will invade your life.

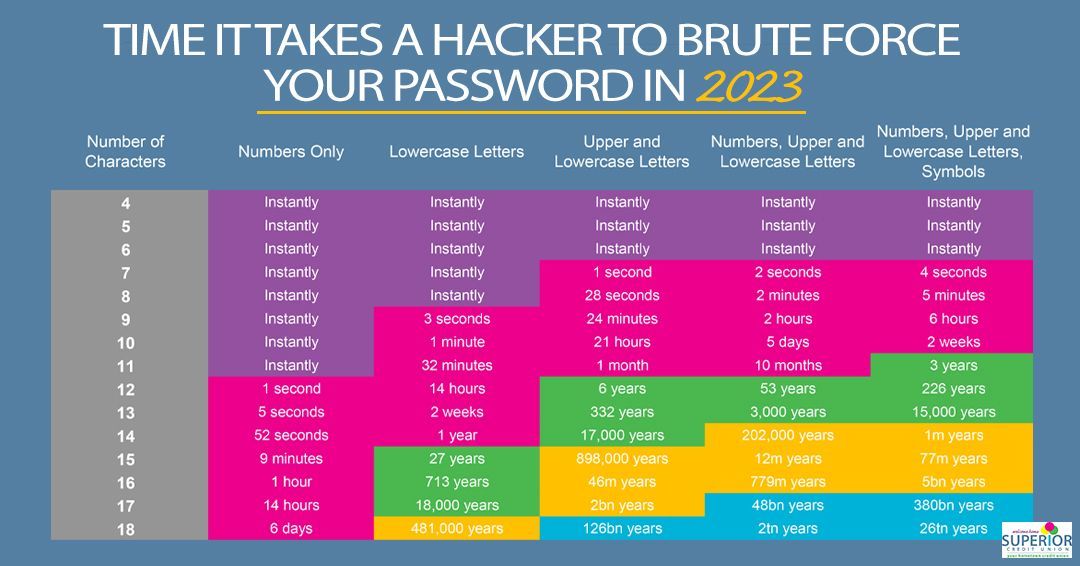

Dynamic Passwords - The first line of defense to any account you have online is your username and password. Really, just your password is what matters. Nope, "password1234" no longer suffices, you have to get more creative. The best passwords have a variation of uppercase and lowercase, at least one number and one symbol. Along these same lines are your security questions. Keep them unpredictable and difficult to guess whenever possible. Get creative with your answers!

Unpredictable PIN's - Another security feature that should be a primary gatekeeper to your account is your pin. Typically 4 digits, there are exactly 10,000 combinations of numbers to choose from. For the average person, that is more than enough to come up with something creative. We always seem to default to the easy PIN's. Birthdays, anniversaries, or even the last 4 of our social security number. This is exactly what a hacker is going to try first. When choosing your pin, go for something that is outside of your personal life, something harder to guess. And beyond all that, NEVER GIVE OUT YOUR PIN TO ANYONE, ever.

Two-factor authentication - Two-factor authentication is an added layer of security that is offered by most apps and websites. This is the practice of sending a one time code to an email or phone number so that even if your password is stolen, there is another level to protecting your private information. It is suggested that you use this wherever it is offered.

Watch your Wi-Fi - Wherever we go there is usually a wi-fi connection available. Some internet providers like Comcast advertise that there is always a hot spot open for their customers. It is very tempting to use a nearby connection if you are out and about and need a faster connection, but this is where you can unknowingly get yourself into trouble. By connecting to an unsecure wi-fi you are essentially opening up your entire device for hackers to look into and steal whatever they would want. Go for reputable, password protected wi-fi connections.

Keep your software up to date - Always ensure you are installing those software updates on your electronic devices. Most times they are released with the latest enhancements to protect your phones and tablets from loopholes that hackers have found. These updates close those loophole and provide yet another level of protection to your electronics.

Check your accounts frequently - The best way to see what is happening in your different accounts is to check them. By regularly checking the activity on all your accounts (more often than just when your statements come), you will catch any suspicious activity right away, before hackers have a chance to do major damage.

Use banking app features wisely - Coupled with tip #6, using the features provided by your financial institution or credit card app is an easy "set it and forget it" way to keep on top of your transactions. Many apps now have notification features that you can customize to let you know by text and/or email every time you make a purchase, or when a deposit/withdrawal exceeds a predetermined limit. This eliminates the need to check each of your accounts often, and you can still trust you will know when unusual activity may happen. (Still check your accounts often, though!)

Use trusted apps - Fraud can come at a consumer from multiple fronts. One of the more popular ones right now is by deceiving users into thinking the website or app they are on is trusted and safe, or by creating copycat versions of popular websites and apps. We go into deeper detail about how to spot a fake website here. Whenever you are shopping online (through a website or app), check the web address, look for misspellings or other anomalies that will tip you off that wherever you are browsing is not authentic. If anything seems suspicious or off, uninstall the app and leave the website. Try again to find the trusted website or app that you were looking for.

Bottom line...

Protecting yourself against fraud can feel like an impossible task. By creating dynamic passwords and PIN's, utilizing in-app safeguards, checking your account activity regularly, and going the extra mile before entering your payment information you can create a space where you lower your overall risk to falling victim to fraud.

Unpredictable PIN's - Another security feature that should be a primary gatekeeper to your account is your pin. Typically 4 digits, there are exactly 10,000 combinations of numbers to choose from. For the average person, that is more than enough to come up with something creative. We always seem to default to the easy PIN's. Birthdays, anniversaries, or even the last 4 of our social security number. This is exactly what a hacker is going to try first. When choosing your pin, go for something that is outside of your personal life, something harder to guess. And beyond all that, NEVER GIVE OUT YOUR PIN TO ANYONE, ever.

Two-factor authentication - Two-factor authentication is an added layer of security that is offered by most apps and websites. This is the practice of sending a one time code to an email or phone number so that even if your password is stolen, there is another level to protecting your private information. It is suggested that you use this wherever it is offered.

Watch your Wi-Fi - Wherever we go there is usually a wi-fi connection available. Some internet providers like Comcast advertise that there is always a hot spot open for their customers. It is very tempting to use a nearby connection if you are out and about and need a faster connection, but this is where you can unknowingly get yourself into trouble. By connecting to an unsecure wi-fi you are essentially opening up your entire device for hackers to look into and steal whatever they would want. Go for reputable, password protected wi-fi connections.

Keep your software up to date - Always ensure you are installing those software updates on your electronic devices. Most times they are released with the latest enhancements to protect your phones and tablets from loopholes that hackers have found. These updates close those loophole and provide yet another level of protection to your electronics.

Check your accounts frequently - The best way to see what is happening in your different accounts is to check them. By regularly checking the activity on all your accounts (more often than just when your statements come), you will catch any suspicious activity right away, before hackers have a chance to do major damage.

Use banking app features wisely - Coupled with tip #6, using the features provided by your financial institution or credit card app is an easy "set it and forget it" way to keep on top of your transactions. Many apps now have notification features that you can customize to let you know by text and/or email every time you make a purchase, or when a deposit/withdrawal exceeds a predetermined limit. This eliminates the need to check each of your accounts often, and you can still trust you will know when unusual activity may happen. (Still check your accounts often, though!)

Use trusted apps - Fraud can come at a consumer from multiple fronts. One of the more popular ones right now is by deceiving users into thinking the website or app they are on is trusted and safe, or by creating copycat versions of popular websites and apps. We go into deeper detail about how to spot a fake website here. Whenever you are shopping online (through a website or app), check the web address, look for misspellings or other anomalies that will tip you off that wherever you are browsing is not authentic. If anything seems suspicious or off, uninstall the app and leave the website. Try again to find the trusted website or app that you were looking for.

Bottom line...

Protecting yourself against fraud can feel like an impossible task. By creating dynamic passwords and PIN's, utilizing in-app safeguards, checking your account activity regularly, and going the extra mile before entering your payment information you can create a space where you lower your overall risk to falling victim to fraud.